Topps and the Stock Market – A Closer Look at the Deal

One of the most iconic names in sports cards is returning to the ranks of the publicly traded. Again.

Earlier this week, Topps struck a deal with Mudrick Capital (most recently of “meme stock fame”) that will result in the listing of Topps shares on the Nasdaq exchange. It’s a path the Company has trod before.

Topps: What’s Old is New

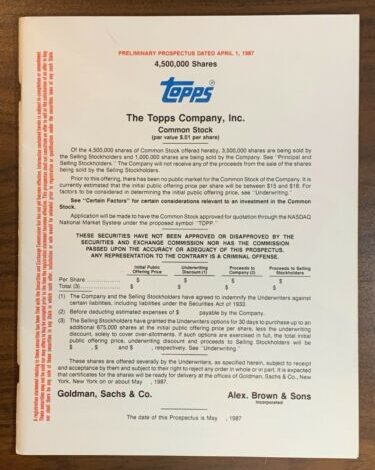

Founded in 1938, and incorporated as Topps Chewing Gum, Inc., in 1947, Topps spent its first quarter-century in the hands of four brothers, before the shares were floated on the public markets in 1972. The shares traded publicly on the American Stock Exchange for a dozen years, until, in the midst of the buyout boom of the 1980s, Topps was acquired for $94.5 million by private equity firm Forstmann Little & Co. Three years later, in the spring of 1987, the Company, now The Topps Company, was once again taken public.

This time the shares traded, on the Nasdaq exchange (under the symbol “TOPP”), for two decades. In October 2007, in the midst of another buyout boom, Topps was acquired for $385 million by private equity firm Madison Dearborn Partners and the private investment firm of former Disney CEO Michael Eisner, The Tornante Company.

Michael Eisner

As part of the deal, all shares of Topps, currently held by Eisner and Madison Dearborn., will be acquired, for $1.3 billion, by Mudrick Capital Acquisition II (“MUDS” on the Nasdaq), a special purpose acquisition companies, or SPAC, founded by Mudrick Capital. The deal is expected to close by Q3 of 2021. On completion of the deal, Eisner will remain chairman of the Company’s board of directors, which will include sports world notables Jill Ellis, a two-time World Cup winner as coach of the U.S. Women’s soccer team, and Marc Lasry, co-owner of the Milwaukee Bucks (himself a PE investor). Michael Brandstaedter will remain President and CEO.

What’s a SPAC??

For the uninitiated, a SPAC is a shell company, with no existing operations of its own, that is created to raise money via an initial public offering (IPO), for the sole purpose of later using the funds raised to acquire another, existing company. Once such a deal is completed, the entities are merged, with the resulting company continuing to trade publicly, under the acquired company’s name.

SPACs offers units (shares of common stock) to investor, via traditional IPO, typically at a price of $10 each. Shareholders have the option of exiting their investments, either by selling on the open market, or by redeeming shares for a prorated portion of IPO proceeds held in a trust. Shareholder that stick around are subject to the normal upside and risks associated with the underlying business of the acquired company.

Though SPACs have existed for more than 15 years, their popularity and prevalence in the financial markets has spiked in recent years (across a range of industries. In fact, 2020 was, thus far, “the year of the SPAC”, with 247 SPAC IPOs generating gross proceeds of approximately $83 billion – nearly half of all IPO proceeds for the year. This not only dwarfed the previous records set in 2019 – deal volume was up 320%, and proceeds jumped 525% – but, according to industry data provider Deal Point, 2020’s marks topped those of the previous five years, combined.

Source: Deal Point

This is because SPACs are a means by which to take a privately-held company public, with far less financial and regulatory burden than a traditional IPO, since these steps have already been taken by the SPAC. Additionally, unlike in traditional IPOs, where valuations are determined over time by bankers, potential investors, earlier financing rounds, and comparable offerings, a SPAC allows for the existing owners to cash out at a price that is set at the time of the agreement.

What’s Next for Topps?

Unsurprisingly, the deal has been the talk of the hobby, with collectors scrambling to try ad figure out its implications, immediate and longer term.

For starters, the deal ensures that sports card and collectibles hobby will remain a topic of conversation in the financial community. The $700 million acquisition of Collectors Universe by a private consortium in February has left Wall Streeters without a direct means of “playing the hobby”. While shares of Topps will obviously reflect the fortunes of the Company, there’s a good chance that will also come to be seen as a benchmark for the industry as a whole.

As a result of the deal’s announcement, we’ve learned the extent to which Topps’ business has benefitted from the recent years’ upswing in hobby interest. Topps’ revenue is generated predominantly via four business segments: trading cards, stickers and albums (sports and non-sports); digital cards and memorabilia; gift cards; and candy. In fiscal 2020, Topps turned a profit of $92 million, on total revenue of $567 million, which was up 23% from 2019, and set a new record for the Company. Interestingly, 65% percent of revenue came from the sports and entertainment collectibles (both physical and digital), with the Company’s confectionary lines (which includes Bazooka gum, Ring Pops, etc.) account for the remaining 35% of sales.

Going forward, it’s likely that Topps maintains its licensing deals with MLB, the MLB Players Association, multiple top European soccer leagues (as well as the Champions League), along with other sports and entertainment entities, including the WWE and Formula 1. That some of the influx of capital will be used to expand offerings within these existing lines – likely at the high-/ultra-high-end, to compete with Panini – seems a reasonable assumption.

Topps is already in the white-hot digital collectibles/non-fungible token (NFT) space, but we should expect to see an expanded selection of NFT and blockchain-based products, both of the Company’s creation and potentially secondary markets. This is unsurprising, not only because the recent explosion in the prices of sports and non-sports NFTs (namely, the NBA’s TopShot) has made the sector “the place to be”, but because this something in which Eisner has previously expressed an interest:

“We are moving from an analog company to a digital company. We have tremendous earnings, great revenue and great cash flow… We’ll be able to do M&A once we are public. It just seemed like the right time. We decided before this boom and blockchain that we are ready to go.”

Additionally, one would assume that Topps will eye re-entry into the basketball and football card markets. Topps was a license holder for the manufacturer of NBA basketball cards until 2009 and NFL football cards until 2015, before Panini (which owns Donruss and NBA Hoops, among other brands) inked exclusive deals with the two leagues. Previous Topps cards were very popular with collectors, and Topps (and Topps Chrome and Bowman) rookie cards remain the most sought after highly valued NBA and NFL stars.

There is also speculation that Eisner could use his relationship with Disney – with whom Panini currently holds a licensing deal – to become a licensed producer of cards and collectibles featuring characters from Disney’s seemingly endless stable, which includes Star Wars, Marvel, and Pixar.

Now, as anyone with firsthand experience – as a shareholder, employee or customer – in the private-to-public process, “for better and for worse” is often an operative disclaimer.

On the one hand, becoming a public company provides easier access to many different funding channels at competitive rates. However, this access is accompanied by a new set of responsibilities, to public shareholders, whose interests are not always aligned with those of customers.

Public listing bring with it formal standards of transparency and disclosure to which private companies simply are not required to adhere. There will be analyst and investor calls, and quarterly earnings reports, the focus of which are hard numbers: the current and future top (revenue) and bottom lines (profit). When this becomes a company’s primary focus, “short termism” tends to win out.

In the case of Topps, this could manifest either in overproduction (and a new “junk wax era” or, as Panini has done with considerable success, consistent and aggressive flexing of pricing-power muscles.

And the Hobby?

Also, it bears mentioning that SPACs re at their most effective when they are bargain-hunting in markets in which quality assets can be had at a discount. In other words, markets the likes of which we saw in early- to mid-2020, in which volatility and uncertainty depressed valuations. However, with the U.S. equities markets effectively brushing aside the specter of any lasting economic impact of the pandemic, and making new all-time highs, the current environment is more fraught.

There are industry-specific concerns as well. It remains to be seen whether the current softening in sports cards is merely a temporary breather in the midst of a long-term uptrend, or the bursting of a nostalgia-fueled bubble inflated by an abundance of free time and disposable income. Reality, as it annoyingly tends to do, likely resides somewhere in the middle, but where on that spectrum it sits is a very real question.

Against this backdrop, another massive wave of supply is building. PSA, faced with a massive backlog of orders, has effectively halted new business in order to catch up. It’s reasonable to assume that (conservatively) another couple of million of cards are sitting with BGS, SGC, and other grading companies. It’s not crazy to think that up to fifteen million new slabs could be stirred into the market over the next several months.

Finally, there is an observable pattern in Topps’ own history that, while hardly conclusive, could be seen as a red flag. In the mid-1980s, Topps was acquired during a buyout boom, and reintroduced to the public markets a few months before a stock market crash and a recession. Topps’ second buyout, in 2007, came with the stock market at an all-time-high, amid an unprecedented boom in private equity-backed buyouts. It was followed months later by a stock market crash and the onset of the Great Recession.

Again, this is merely a summation what has been, and not necessarily what will be, but it is something to bear in mind.

Now, it is worth noting that Topps’ ownership group did stay the course, neither cashing out at the first hint of recovery, nor strip-mining the Company’s assets. Unlike many a previous private equity target, Topps is not over-leveraged, its net debt of less than $150 million representing roughly 10% of enterprise value. And the same leadership is still around, striking a very optimistic tone.

What comes next? Who knows. It does, however, seem as though the hobby is at an inflection points, with Topps as a canary in the coal mine.

SC Daily contributing writer Emile Avanessian has a background in investment banking and research, financial analysis and risk management, at some of the world’s leading companies, including Goldman Sachs, HSBC, Citi, Société Générale, PayPal and Take-2 Interactive Software.